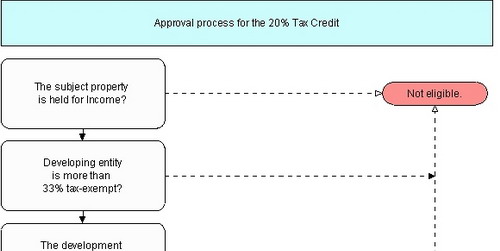

Rehabilitation of a historic structure could provide you, the developer, with a sizable tax credit — a dollar-for-dollar reduction of income tax liability. If your project qualifies, you are eligible for a credit equal to 20% of the rehabilitation expenditures, — often millions of dollars.

Does your property qualify for money-saving tax credits?

Review this checklist and find out:

- The building is, or can be, a “certified historic structure.”

- The planned renovation constitutes a “substantial rehabilitation,”. i.e. one greater than $5,000 or the adjusted basis in the building.

- The building is a depreciable income property held for use in trade or business, or as an investment property.

- The property will be rehabilitated according to the Secretary of the Interior’s Standards for Rehabilitation.

- The entity (partnership) applying for the tax credit has not altered the building in any way since taking possession of it.

If your historic rehabilitation project does not fulfill above criteria, your project may qualify for the 10% Historic Rehabilitation Tax Credit if:

- The building cannot be a certified historic structure, but was built before 1936.

- The re-use will be commercial and not residential.

- At least 75% of the walls will be kept in place.

Don’t miss any potential savings.

For more details on qualification, applicable tax rules and to initiate a tax credit application, contact Historic Consultants today.